Financial Lending: How Direct Mail Can Help You Convert More Leads into Borrowers

This is probably not the first time you’ve heard that consumers are inundated by digital marketing. We know it, as we live it every day! From the time we wake, until the time we lay our heads down on our pillows, we are hit from every direction with digital messaging, both in our professional and personal lives. We log into our work email in the morning and are pummeled by hundreds of spam messages. We hop onto Facebook at night to find creepy ads that make the average (non-marketing) person wonder if someone is watching their every move. Even our phones haunt us with ads. At the onset of digital marketing, it worked amazingly well. Remember when we all LOVED email – and read every message we received!? But fast forward 20 years, and consumers have become accustomed to ignoring digital marketing efforts, even the creepy ones. And it is easy to “turn off” digital marketing by unsubscribing to emails or opting-out of Google’s remarketing ads.

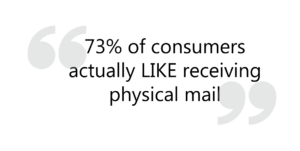

Direct mail, on the other hand, is harder to ignore and, actually, people don’t want to ignore it! An ICR study revealed that 73% of consumers actually LIKE receiving physical mail over other forms of advertising. They find it more reliable and trustworthy than a strange company hiding behind a computer sending spammy emails. So when it comes to marketing your lending business, will you put all of your marketing apples into the digital basket? Or, will you try an old tactic that is providing marketers with a better ROI than email?

Whether you are looking to market capital funding, home loans or mortgage re-financing, a well-designed direct mail piece sent to a high-quality targeted mail list can be the push that your company needs to write more loans. With today’s print technology, you can easily personalize your direct mail and implement a 1-to-1 marketing campaign that will not only get your prospect’s attention, but lead to more conversions.

Whether you are looking to market capital funding, home loans or mortgage re-financing, a well-designed direct mail piece sent to a high-quality targeted mail list can be the push that your company needs to write more loans. With today’s print technology, you can easily personalize your direct mail and implement a 1-to-1 marketing campaign that will not only get your prospect’s attention, but lead to more conversions.

HOW TO GET YOUR DIRECT MAIL OPENED

The key to converting leads into sales using direct mail is to, first, get the envelope opened. Great! How do you do that?

Envelope Messaging

There are a number of ways you can create a sense of urgency using copy on the outside of the envelope. “DO NOT BEND”, “TIME SENSITIVE” or “NEW CARD ENCLOSED” are surefire ways to pique interest and improve open rates. However, you’ll want to avoid using copy that is any way misleading, as that will just create animosity and ensure a lost opportunity.

Enticing Contents

Paper alone may not be enough to entice your prospect to open the envelope, unless it looks like important official business. However, place a sturdy plastic card or two inside and, voilà!, you have just added perceived value to your mailing. Plus, a card can be used for more than just getting the envelope opened. By personalizing it with the recipient’s name, and adding a personal offer number or a promotional message, you can drive more conversions. A card is also a great way to keep your message in front of your potential customer, as they can easily save it to follow up with you at a later time. A simple refer-a-friend program can be created by adding a second card (or several cards) that can be shared with other potential customers (aka, friends and family.)

Another way to get your envelope opened is to pique their curiosity. By using a window envelope, you can strategically place a card just within view of the window, which will trigger the recipient to open it.

HOW TO GET MORE CONVERSIONS

Custom landing pages

We are in an age of personalization, so who doesn’t love a vanity landing page!? A personalized URL (PURL) can be used in your direct mail to drive the prospect to a webpage devoted to them. This personalized page allows you to expand on your offer, create messaging that is tailored to each individual, and further engage with the prospect in a controlled environment. PURLs also allow you to track your campaign and measure ROI. Keep your landing page simple with a clear call-to-action (CTA) to encourage the next step in the loan process.

Create a sense of urgency

Add an expiration date to your card and/or letter to remind your prospect that your offer won’t last for long. Again, remember to keep your CTA simple and clear so they know what to do next to secure a loan.

Create a compelling offer

In order to convert leads into customers, your direct mail offer has to be enticing enough for them to reach out to you. Remember to tailor the marketing message to match the interest of the prospective customer. Advertising a low interest rate is a traditional marketing tactic, however, this may not be a driver for some consumers. Know your audience and segment your list so that you can send a targeted offer that solves their pain point, whether that’s bad credit or too much debt.

Use graphics + white space

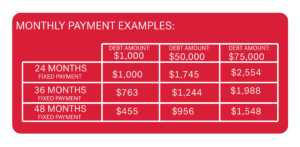

Did you know that the brain processes images 60,000 times faster than text? Visual content drives engagement, is easier to comprehend and is better remembered. Your direct mail piece should include photos, graphics, and even white space to help break up your text into more digestible servings. Examples of monthly payments or a cost savings graphic would help your prospect “visualize” a loan with you.

These are just a few tips to help you create a successful direct mail piece. If you’d like to learn about adding a card to help increase lift on your next direct mail campaign, visit our website at cpscards.com or contact us. In the meantime, here are a few more ways that cards help to improve lift and conversions: